A Historic Plunge for the Nikkei 225

Japan’s Nikkei 225 index experienced its worst day since the infamous “Black Monday” crash of 1987, plunging 12.4% on Monday. The index closed at 31,458.42, marking a massive loss of 4,451.28 points—the largest in terms of points in its history. This sharp decline has wiped out all the gains made by the index this year, pushing it into a loss position year-to-date.

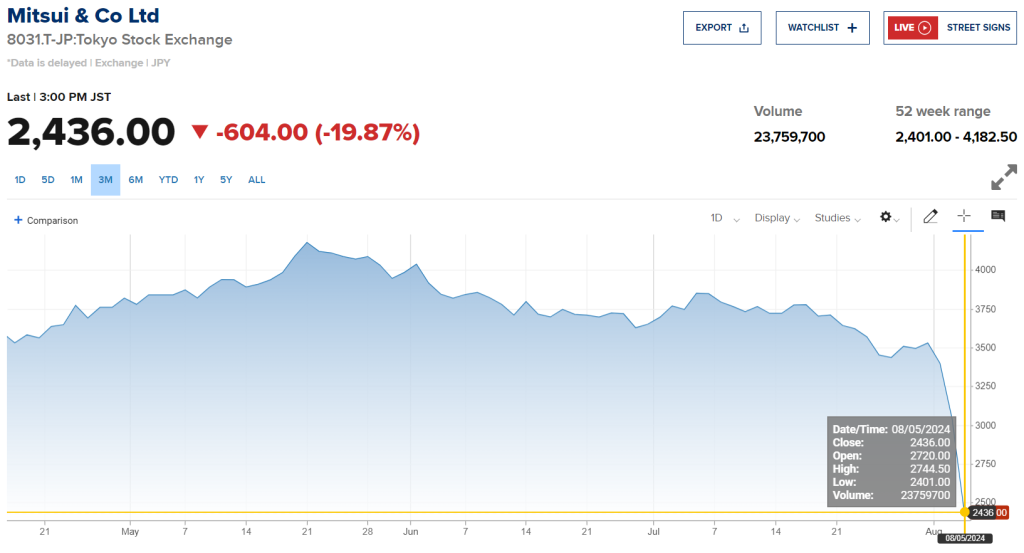

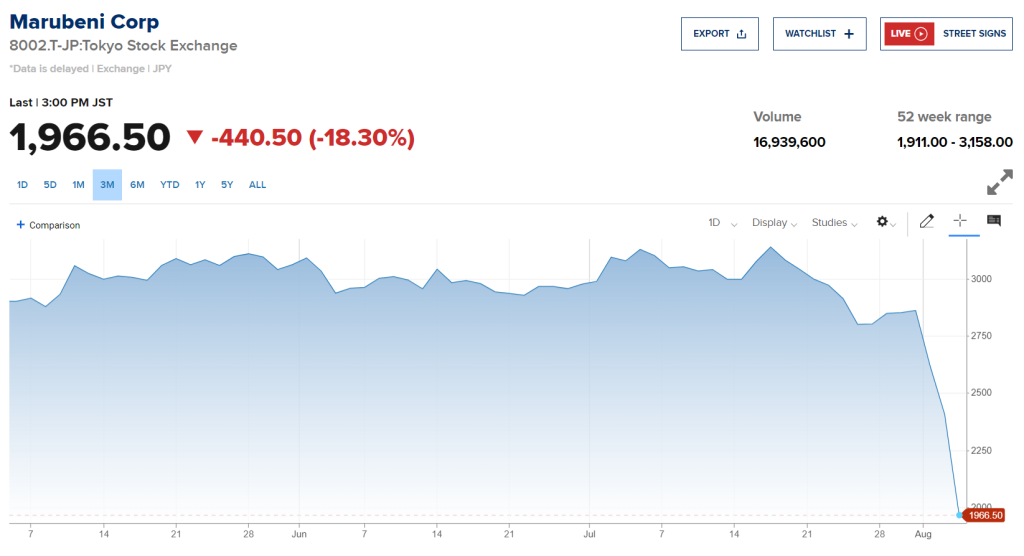

Impact on Major Japanese Stocks

Heavyweight trading houses, including Mitsubishi, Mitsui & Co, Sumitomo, and Marubeni, saw significant losses, with Mitsui experiencing a near 20% drop in market capitalization. The broader Topix index also tumbled 12.23%, closing at 2,227.15. The sharp decline in these indices highlights the extent of the market turmoil.

Global Market Reaction and Economic Indicators

The dramatic sell-off in Japan echoed across other Asian markets. South Korea’s Kospi fell 8.77%, while the small-cap Kosdaq index saw an 11.3% drop. The Taiwan Weighted Index also declined by over 8%, and Australia’s S&P/ASX 200 fell 3.7% to 7,649.6.

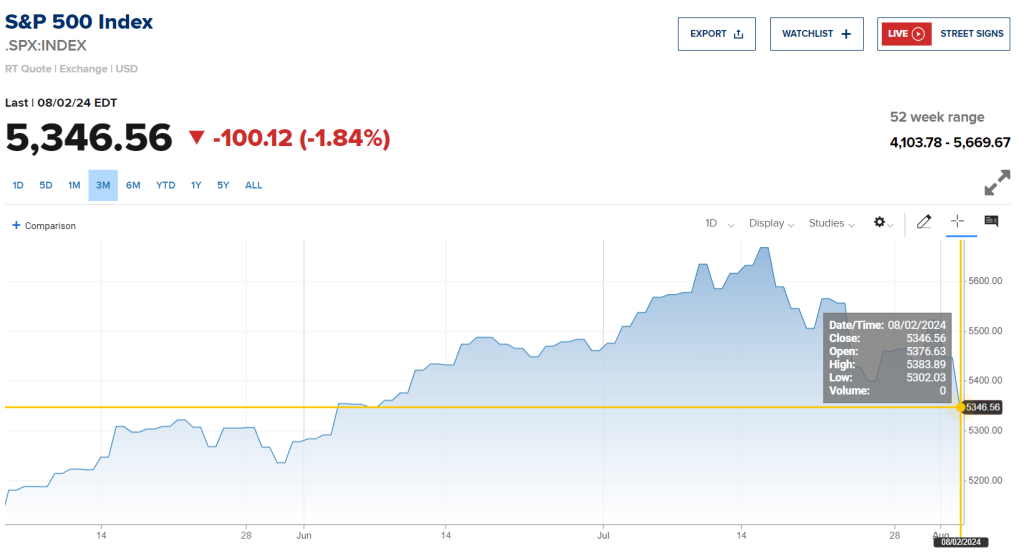

The sell-off was triggered by a combination of weak economic data from the U.S. and concerns over the global economic outlook. On Friday, a weaker-than-expected U.S. jobs report heightened fears of a potential recession, causing the Nasdaq Composite, S&P 500, and Dow Jones Industrial Average to fall sharply.

Yen Strengthens Amid Market Turmoil

In addition to the stock market declines, the yen strengthened to its highest level against the dollar since January, trading at 142.09. A stronger yen typically hurts Japanese exporters, adding further pressure to the market.

Circuit Breakers Activated

The magnitude of the sell-off was so severe that circuit breakers were activated to halt trading temporarily in both Japan and South Korea. These measures, designed to prevent panic selling, highlight the extreme volatility and investor anxiety prevalent in the markets.

How Nikkei 225 Holding Up to Global Indices

The Nikkei 225’s recent performance contrasts sharply with other global indices. For instance, the S&P 500 dropped 1.8%, and the Dow Jones fell 1.5% early Monday. The S&P 500’s trading hours and performance are crucial for global investors, and the index’s decline reflects broader market apprehensions about the U.S. economy.

Economic Data and Central Bank Policies

Investors are closely watching key trade data from China and Taiwan, as well as central bank decisions from Australia and India. The Reserve Bank of Australia is expected to hold rates steady at 4.35%, but any deviation could impact global market sentiment.

In China, the service sector expanded at a faster pace in July, with the Purchasing Managers’ Index climbing to 52.1 from 51.2 in June. This growth, supported by sustained improvements in demand conditions and service offerings, provides a glimmer of hope amid the global market turbulence.

The unprecedented drop in Japan’s Nikkei 225 index underscores the heightened volatility and uncertainty in global markets. As investors navigate these tumultuous times, the performance of key indices like the Japan Nikkei 225, S&P 500, and other global benchmarks will continue to be closely monitored. The interplay between economic data, central bank policies, and market sentiment will be critical in shaping the future trajectory of the global economy and stock markets.