What Led to the DirecTV and Disney Blackout?

The current impasse between DirecTV and Disney is the latest example of a carriage dispute, a common conflict in the television industry where programming companies and distributors clash over contract renewals. These contracts typically expire during peak viewing periods, giving both parties leverage in negotiations. In this case, the timing of the expiration coincided with the Labor Day weekend, a period of heightened viewer interest due to major sports events.

Disney has been at the center of several similar disputes in recent years. The company demands high fees from distributors for channels like ESPN, while simultaneously investing heavily in content for its streaming platforms, such as Disney+ and ESPN+. This strategy has led to tensions with distributors who are reluctant to pay more for content that may also be available on streaming services.

The DirecTV and Disney dispute is not an isolated incident. Similar conflicts have arisen across the industry, reflecting broader challenges facing traditional TV providers and content creators. As consumers increasingly cut the cord in favor of streaming services, both sides are grappling with how to adapt to this new landscape. Traditional cable and satellite TV providers are pushing for more flexible and affordable bundles, while content creators like Disney are looking to maximize revenue through both traditional distribution channels and direct-to-consumer streaming services.

DirecTV’s Stand: Seeking Flexibility and Fairness

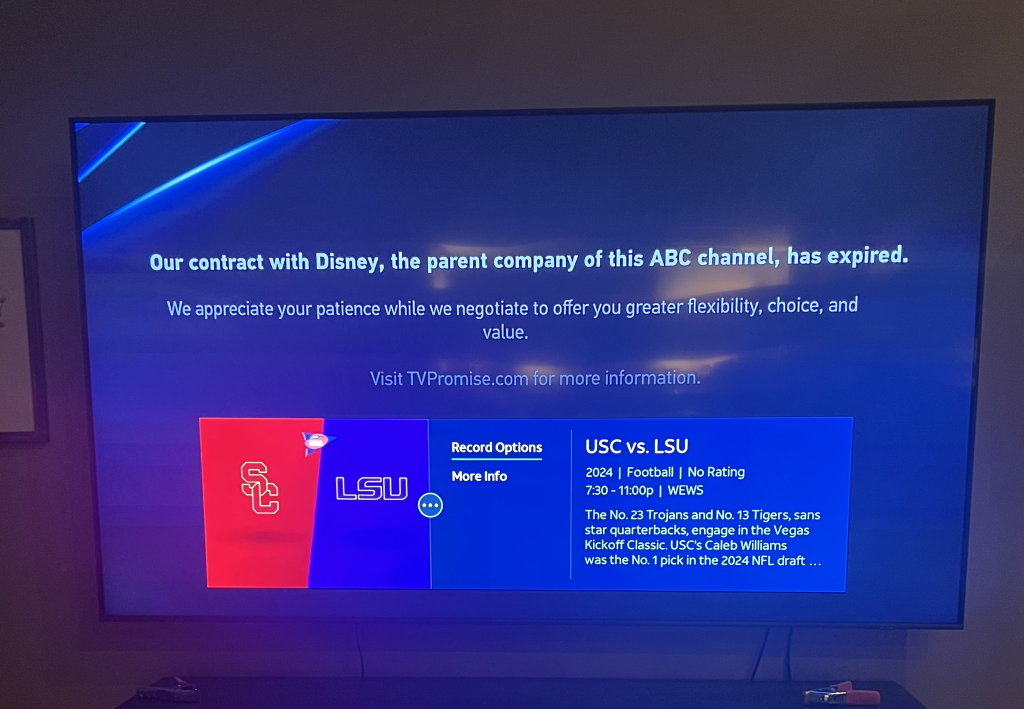

DirecTV, on its part, argues that Disney’s demands are unreasonable and contribute to rising costs for consumers. The satellite TV provider has called for more flexible bundling options that would allow customers to choose packages tailored to their viewing preferences, such as sports-only bundles. DirecTV contends that Disney has resisted these changes while shifting its most valuable content to its streaming platforms, forcing traditional TV subscribers to pay more for less content.

These disputes often lead to temporary blackouts that frustrate customers, potentially driving them away from traditional TV services altogether. While both parties typically have a vested interest in resolving these disputes quickly to minimize customer loss and revenue impact, the frequency and intensity of these conflicts suggest a more profound shift in the television industry.

Rob Thun, DirecTV’s chief content officer, stated, “Disney’s only magic is forcing prices to go up while simultaneously making its content disappear.” Thun criticized Disney for demanding concessions that would waive all future legal claims regarding its behavior and shift any future litigation to California, a move DirecTV sees as a way for Disney to avoid accountability.

Disney’s Response: Defending Content Value

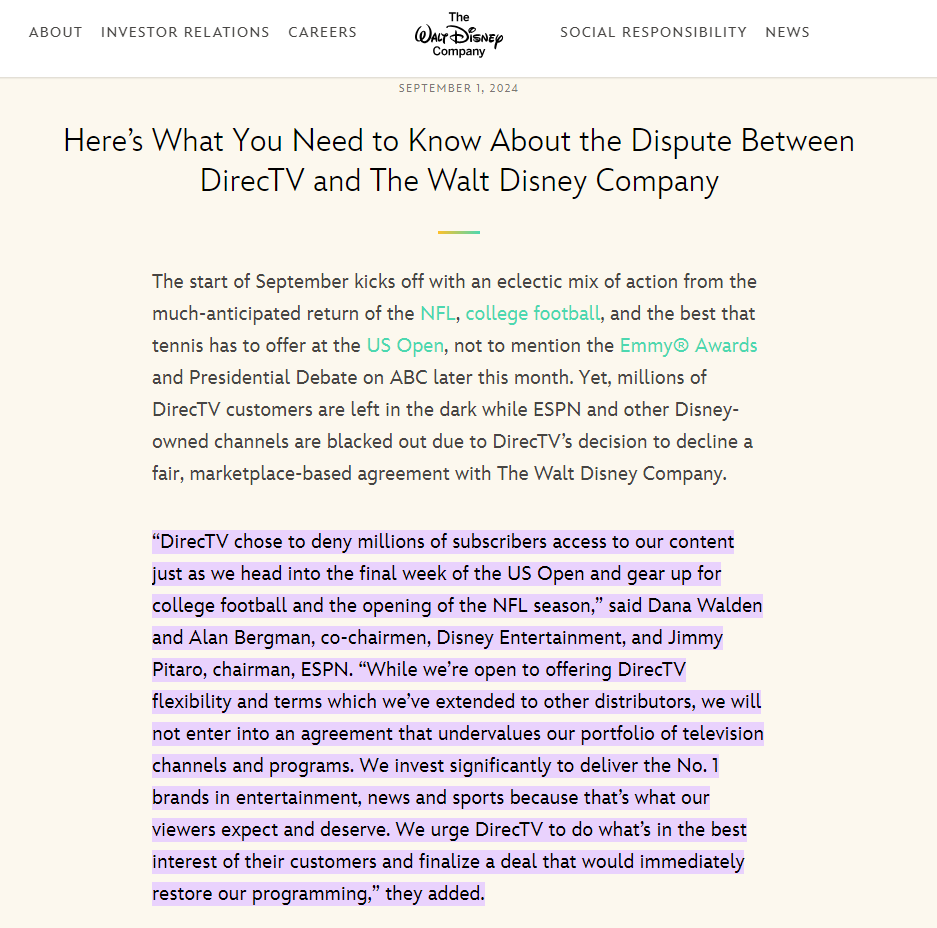

From Disney’s perspective, the fees it requests from DirecTV are justified based on the value of its extensive portfolio of networks, which includes not only ESPN and ABC but also FX, National Geographic, and the Disney Channel. Disney maintains that its programming is top-tier in news, sports, and entertainment, and that the investment in these channels necessitates higher fees.

“We invest significantly to deliver the No. 1 brands in entertainment, news, and sports because that’s what our viewers expect and deserve,” Disney executives Dana Walden, Alan Bergman, and Jimmy Pitaro said in a statement. Disney has urged DirecTV to reach a fair agreement that would restore access to their channels immediately, emphasizing the inconvenience to consumers caused by the blackout.

An Ending to the ESPN and DirecTV In Sight for Subscribers ?

For now, DirecTV subscribers are left in the dark, missing out on popular sports and entertainment programming. The dispute not only affects ESPN and ABC but also extends to other Disney-owned networks such as FX and National Geographic. Both companies have set up dedicated websites to communicate their perspectives, with DirecTV promoting “UnbundleDisney.com” and Disney launching “KeepMyNetworks.com.”

Until an agreement is reached, millions of sports fans and TV viewers remain caught in the crossfire. The resolution of this dispute will likely set a precedent for future negotiations between content creators and distributors as the industry continues to evolve.

The outcome of this dispute will be closely watched by industry stakeholders and could shape the future of how content is bundled, priced, and delivered to consumers.