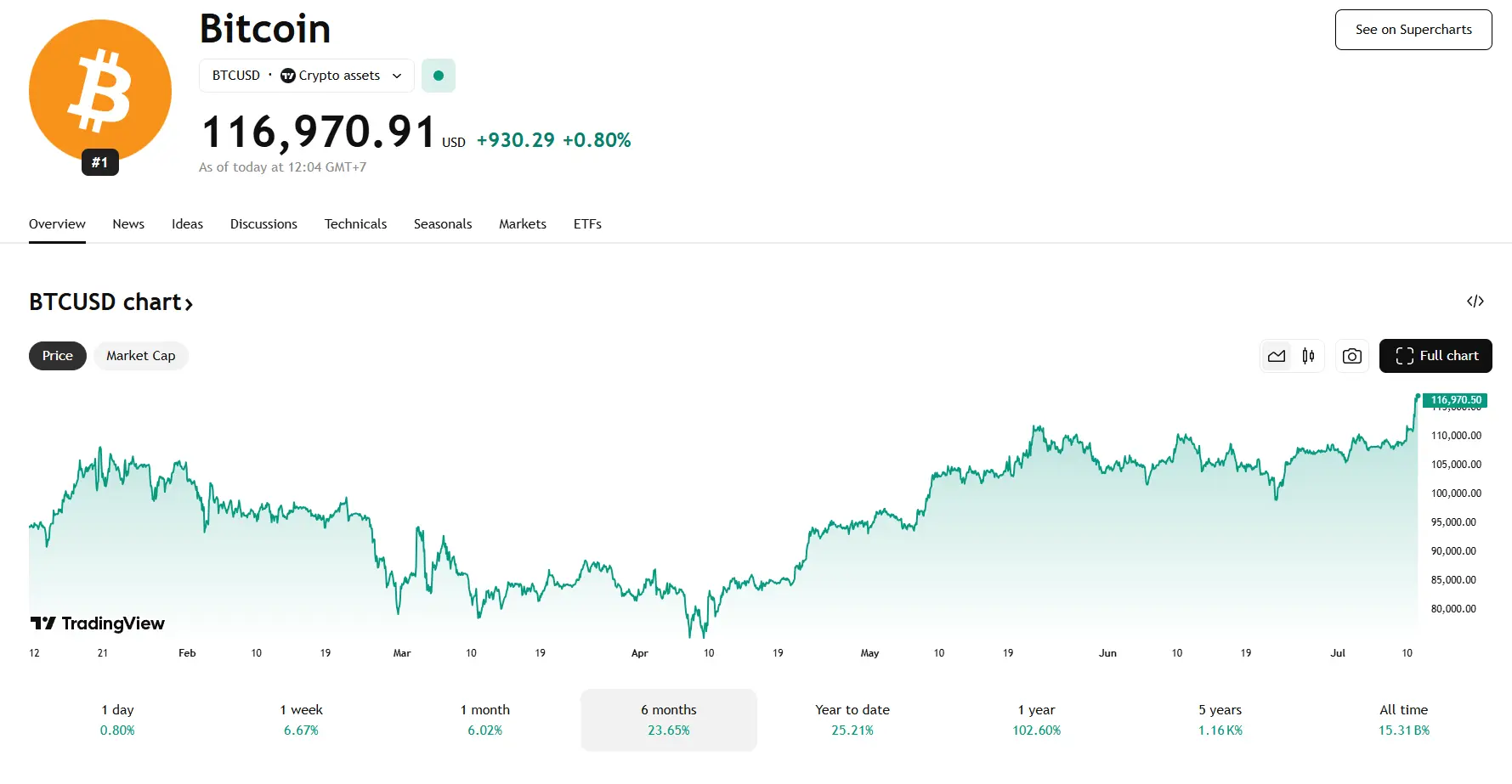

Bitcoin has once again shattered previous milestones, reaching an all-time high of approximately $116,046.44 late Thursday, July 10 — marking a dramatic 24% increase year-to-date. The cryptocurrency continues its unprecedented climb, driven by robust institutional demand and a crypto-friendly policy landscape under President Trump’s administration.

Why Is Bitcoin Price Going Up?

Several critical factors are fueling Bitcoin’s ascent:

-

Institutional Inflows

Large corporations—including MicroStrategy, GameStop, and Figma—are bolstering their balance sheets with Bitcoin holdings. Corporate adoption surged by 23% in Q2 2025, totaling around 847,000 BTC, further validating Bitcoin’s maturity as a treasury asset.

-

Supportive U.S. Policy

President Trump’s executive order establishing a Strategic Bitcoin Reserve and his appointments of crypto-friendly officials at the SEC and White House have improved investor confidence. Plans by Trump Media & Technology Group to launch a crypto-focused ETF have also added momentum.

-

Favorable Macroeconomic Trends

Signs of a slowing Fed, weakening dollar, and easing global monetary policy have spurred risk-on sentiment, encouraging investors to pivot toward Bitcoin. -

ETF Flow and Technical Breakouts

Spot Bitcoin ETFs are experiencing record inflows (over $35 billion in 2025), while technical indicators—RSI and chart resistance breakouts—are signaling continued bullish momentum. Analyst projections suggest upside targets approaching $146,400.

What Is the Current Price of Bitcoin?

As of the latest data:

-

Bitcoin peaked at $116,046.44, eclipsing the earlier high of $113,734.64 set earlier on the same day.

-

Other markets mirrored this surge, with estimates placing Bitcoin around $115,900 at U.S. market close.

Bitcoin Price Prediction

Investor sentiment remains decidedly upbeat, but futures projections vary:

-

Some analysts envision continued upward movement toward $140,000–146,000, based on chart technicals.

-

Longer-term forecasts vary widely: Bitwise predicts $200,000+, VanEck expects $180,000, and Gene Munster’s firm targets $150,000 by year-end.

-

One bullish analyst, Tom Lee, even sees Bitcoin climbing above $250,000 if demand continues to outpace supply.

Risks To Consider

-

Volatility: Analysts warn Bitcoin may drop by ~30% after new highs, leading to consolidation before further surges.

-

Macroeconomic variables: Upcoming CPI reports, Fed rate policies, and global trade tensions may impact risk appetite—and Bitcoin’s trajectory .

-

Regulatory outcomes: Crypto legislation during “Crypto Week” or executive actions could reshape future expectations

Key Levels to Monitor

| Price Level | Significance |

|---|---|

| $116,000+ | All-time high set on July 10–11 |

| $114,000 | Confirmed breakout point; signals further upside |

| $110,000–113,000 | Technical support region with strong institutional holdings |

| $100,000 | Psychological floor and historical support |

With a market cap around $2.2 trillion, Bitcoin has surpassed major companies like Alphabet, becoming a top-tier global asset. This dominance enables both institutional and retail investors to consider it seriously as digital gold. Its growing correlation with risk assets also positions it as a key barometer of investor sentiment. Bitcoin’s explosive surge to new records—now over $116K—is underpinned by institutional inflows, supportive U.S. policy, and bullish technical signals. While analysts agree on further upside, ranging from $180K to $230K this year, volatility remains a constant backdrop. Key levels between $110K–114K will determine next moves, and macroeconomic or regulatory shocks could trigger abrupt corrections. Yet, as adoption deepens and government sentiment turns positive, Bitcoin’s climb may well be just beginning.