DNUT Stock Surges on Retail Frenzy

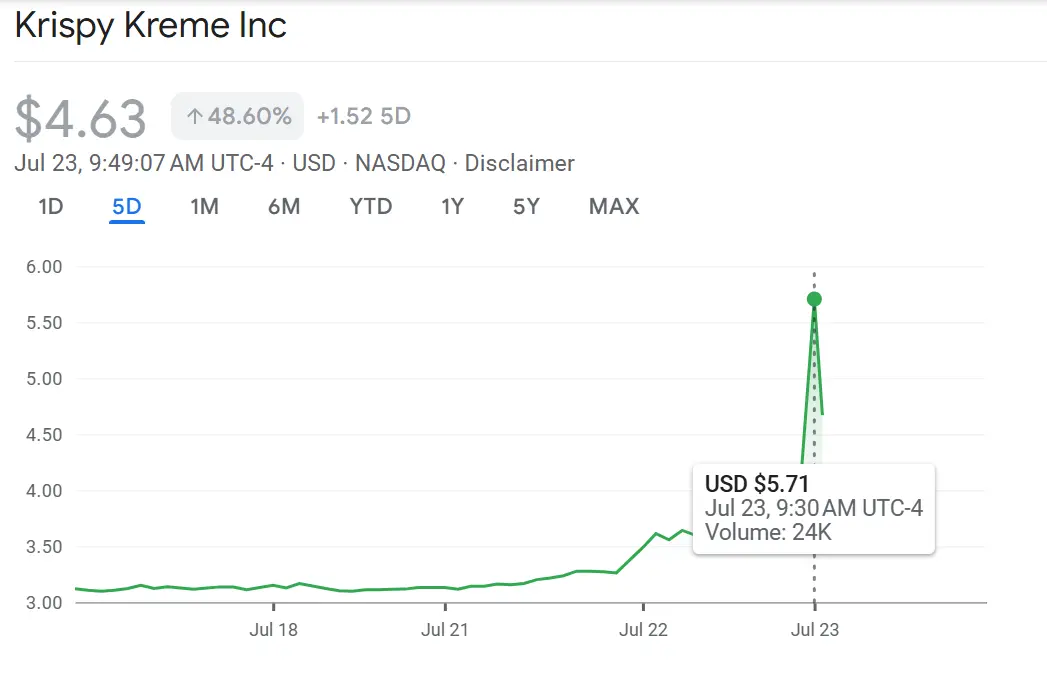

Shares of Krispy Kreme (NASDAQ: DNUT) exploded in early trading on July 23, jumping roughly 33% after spiking about 27% the previous day. This dramatic surge has positioned DNUT as the latest meme stock, drawing in retail investors and social media-driven speculation.

What Qualifies DNUT as a Meme Stock?

Analysts point to several key traits of meme stock setups that DNUT fits perfectly:

-

High short interest: Around 32% of DNUT’s float is currently shorted.

-

Low share price: Convenient access appeals to retail traders looking for dramatic moves.

-

Strong brand recognition: Krispy Kreme’s nostalgic reputation fuels online hype.

-

Social media momentum: Active chatter on Reddit forums like r/wallstreetbets has accelerated demand.

This mirrors the GameStop and AMC phenomena from 2021, where heavily shorted stocks rallied sharply due to coordinated retail buying.

DNUT isn’t alone—GoPro (GPRO) surged 39–45%, while Beyond Meat (BYND) and 1‑800‑Flowers (FLWS) also saw notable gains. This wave of meme stock interest is reminiscent of past rallies, with retail traders targeting nostalgic or distressed brands.

Despite the rally, DNUT’s financials remain weak:

-

Q4 performance: Revenue fell 10% to $404 million; EPS came in at $0.01 vs. $0.09 expected.

-

Cost-cutting moves: Dividend paused, McDonald’s partnership ended, store closures underway.

-

Stock value: Trading around $3–4, down ~65% YTD.

Clearly, DNUT’s surge is driven more by short-squeeze momentum than investor confidence in fundamentals.

Risky Considerations of Meme Stocks

Technical analysts highlight DNUT’s high short interest and low float as propelling a classic short squeeze. MarketWatch notes that tech and crypto sentiment may be spillover factors encouraging meme-stock plays.

However, skeptics caution that without underlying improvement, current levels are fragile. DNUT’s lack of earnings rebound and debt challenges raise concerns about sustainability, echoing warnings from meme stock veterans.

Beware the Meme Trap

Fast Company emphasizes the volatility of meme stocks like DNUT:

“Meme stocks are driven by hype… not company fundamentals… they can crash as quickly as they soar.”

Investopedia notes sizable YTD declines (DNUT down ~50%) despite recent rallies, stressing that meme stock gains often reverse without sustainable catalysts.

What Investors Should Do

-

Monitor short interest: A high short ratio (~32%) means squeezes can occur—but also unwind fast.

-

Track technical signals: RSI/KDJ indicators and social media sentiment can forecast short-term bursts.

-

Manage risk: Use tight stop-losses and avoid overexposure—volatility is intense.

-

Consider fundamentals: If DNUT’s underlying business doesn’t improve, upside may vanish as hype fades.

Is the Meme Stock Rally Here to Stay?

The July 2025 meme stock rally is thriving against a backdrop of high liquidity, low central-bank rates, and continued retail trading enthusiasm. With DNUT now in focus, retail investors are scanning for the next distressed retailer or nostalgic brand to ride.

Still, the meme market remains unpredictable—sometimes rewarding but often unforgiving. As DNUT leads the charge with GPRO and BYND, the meme-stock cycle may indicate broader investor sentiment—but caution is paramount.

DNUT stock’s leap into meme-stock territory reflects a potent mix of high short interest, social-media virality, and nostalgic brand buzz. Yet, without improved financials, the rally may prove short-lived. Retail investors eyeing DNUT should weigh the thrill of a short squeeze against the sharp risk of collapse. In this era of meme mania, discerning thrill-seekers from long-term bettors is more important than ever.