Meta Platforms, Inc., the parent company of Facebook, Instagram, and WhatsApp, is starting 2025 with a significant workforce reduction, cutting about 5% of its global staff. These layoffs align with CEO Mark Zuckerberg’s commitment to streamline operations as part of an ongoing “Year of Efficiency” initiative. As Meta stock reacts to the news, here’s a breakdown of the situation and its implications.

What Is Meta?

Meta Platforms, Inc. is a technology conglomerate known for its social media platforms—Facebook, Instagram, and WhatsApp—and its pioneering efforts in virtual reality through Reality Labs. With its ambitious investment in the Metaverse, Meta aims to shape the next era of digital interaction. However, challenges such as low adoption rates, high costs, and technological hurdles have slowed the Metaverse’s progress, prompting a strategic shift back to the company’s core businesses.

Meta Layoffs: A Strategic Reset

The recent layoffs at Meta will impact approximately 3,600 employees, representing about 5% of its workforce. According to Zuckerberg, these cuts are performance-based, targeting the company’s “lowest performers” in a move to enhance productivity and efficiency.

“I’ve decided to raise the bar on performance management and move out low performers faster,” Zuckerberg said in an internal memo. He emphasized that these roles would be backfilled later in the year as the company realigns its priorities toward artificial intelligence (AI), smart glasses, and the future of social media.

This marks the latest in a series of workforce reductions at Meta. The company previously laid off 11,000 employees in November 2022, followed by another 10,000 in 2023. These cuts were part of Zuckerberg’s broader effort to streamline operations amid slowing revenue growth and rising costs.

How Meta Stock Reflects to the Layoff News

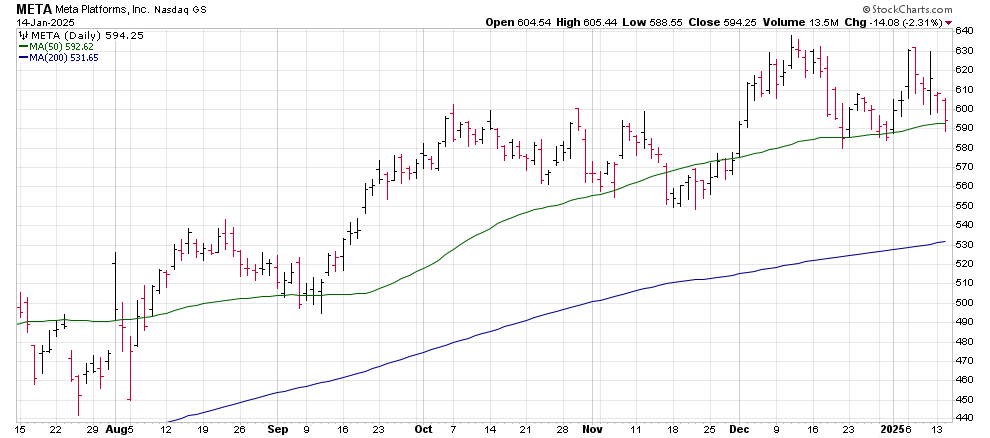

The announcement of layoffs has had an immediate effect on Meta stock, which dipped below $600 following the news. The stock had recently reached all-time highs, buoyed by investor optimism around Meta’s renewed focus on profitability and its core business areas.

Despite the dip, analysts remain bullish on Meta’s long-term prospects. Shares have climbed nearly 200% since the company scaled back its investment in the Metaverse and redirected resources toward more profitable ventures. The stock is expected to find support around $575, with a price target of $700, reflecting confidence in the company’s ability to innovate and adapt.

Major Operational Shifts at Meta

The layoffs come amid broader operational changes at Meta. The company recently ended its third-party fact-checking program in favor of a “Community Notes” system, similar to the model used on Elon Musk’s X platform. Additionally, Meta has scaled back diversity initiatives and revised its content moderation policies to allow more flexibility in discussions around controversial topics.

These shifts have drawn criticism, with some viewing them as politically motivated. However, Zuckerberg has defended the changes, arguing they are necessary to restore trust, reduce errors, and promote free expression on Meta’s platforms.

Mark Zuckerberg’s vision for Meta’s Future

The layoffs and operational changes reflect Meta’s efforts to navigate a rapidly evolving technology landscape. While the immediate impact may include workforce disruptions and public scrutiny, these moves are part of a broader strategy to enhance efficiency and drive innovation in artificial intelligence, augmented reality, and social media.

For investors, the performance of Meta stock serves as a barometer of confidence in the company’s strategy. The slight decline following the layoff announcement may signal uncertainty, but the stock’s long-term growth trajectory suggests resilience.

Meta’s decision to cut 5% of its workforce marks another step in its journey to optimize performance and strengthen its position in the tech industry. While the move may present short-term challenges, it aligns with the company’s goal of achieving greater efficiency and innovation.