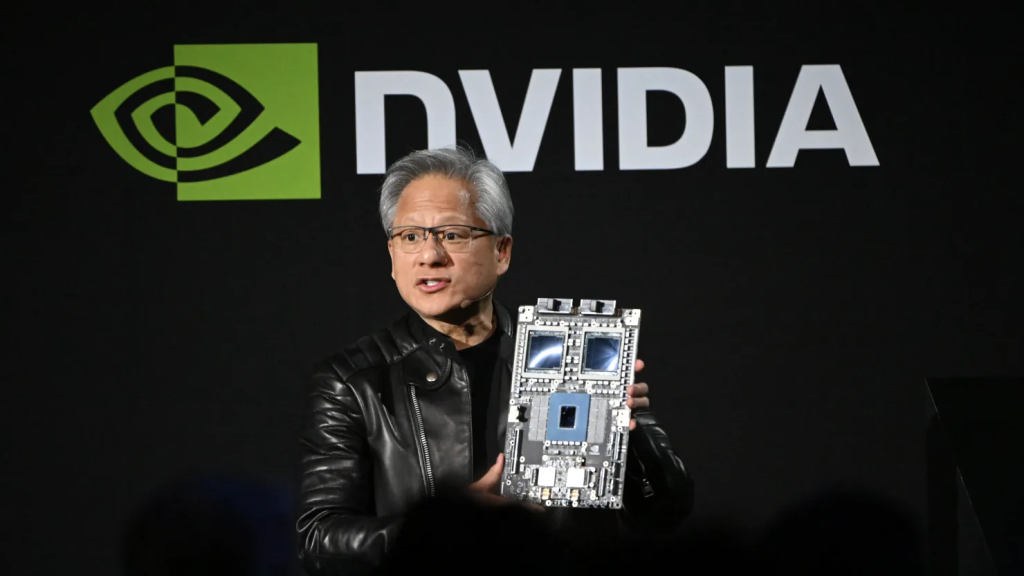

What Is Nvidia?

Founded in 1993 in a Silicon Valley diner, Nvidia started as a graphics chip company but has since transformed into the undisputed leader in AI and accelerated computing. Its advanced hardware and software power applications ranging from generative AI to autonomous vehicles and robotics. Today, Nvidia’s market capitalization surpasses $3.5 trillion, making it the most valuable publicly traded company globally.

Nvidia Earnings Report: Record Revenue Driven by AI Boom

For the quarter ending October 27, 2024, Nvidia reported record revenue of $35.1 billion, up 94% year-over-year and 17% from the previous quarter. The surge was primarily fueled by the AI-driven growth in its data center segment, which contributed a staggering $30.8 billion, a 112% increase year-over-year.

Nvidia’s non-GAAP earnings per share (EPS) stood at $0.81, surpassing analyst expectations of $0.75. The company’s guidance for Q4 revenue, estimated at $37.5 billion, also exceeded Wall Street’s consensus of $37.09 billion, reflecting continued demand for its cutting-edge AI chips like Hopper and the next-generation Blackwell.

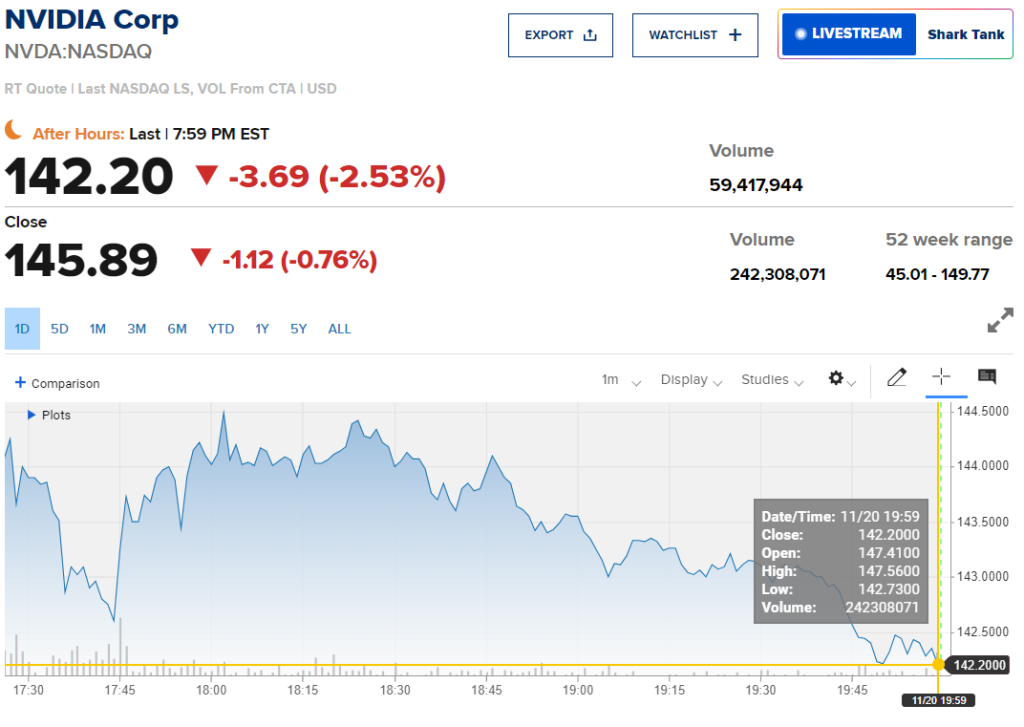

Why Did Nvidia Stock Fall After the Earnings Beat?

Despite Nvidia’s record-breaking performance, its stock slipped as much as 3% in after-hours trading. Analysts attribute this to sky-high investor expectations and concerns over slowing sequential growth. Nvidia’s Q4 guidance implies a 7% quarter-over-quarter revenue increase, marking its weakest growth since early 2023.

The dip in Nvidia stock price also wiped nearly $100 billion in market capitalization, equivalent to the total valuation of rival chipmaker Intel. However, the decline was moderated during Nvidia’s earnings call, as CFO Colette Kress highlighted “staggering demand” for Blackwell chips.

Key Takeaways from Nvidia’s Growth Segments

1. Data Center Dominance

Nvidia’s data center segment continues to be its growth engine, riding the wave of generative AI adoption. Sales surged 112% year-over-year, driven by partnerships with tech giants like Microsoft, Oracle, and OpenAI. The rollout of the Blackwell platform and Hopper H200 chips is set to sustain growth, though supply constraints may persist into fiscal 2026.

2. Gaming Sector Resilience

The gaming division reported $3.3 billion in revenue, up 15% year-over-year, benefiting from increased GPU demand and console sales. Nvidia’s roots in gaming remain strong, with innovations like GeForce RTX and AI-enhanced gaming experiences continuing to attract users.

3. Automotive and AI Expansion

Nvidia’s automotive segment grew 72% year-over-year, contributing $449 million, as self-driving technologies gain traction. Meanwhile, its AI solutions are now integrated across industries, from telecommunications to industrial robotics, further diversifying its revenue streams.

Challenges Ahead for Nvidia

Nvidia faces potential headwinds, including geopolitical uncertainties. U.S. tariffs on Taiwan-made chips, where Nvidia relies on TSMC for manufacturing, could impact pricing and margins. Additionally, constrained supply for new Blackwell GPUs may temper short-term growth.

Outlook for Nvidia Stock

Despite the post-earnings dip, Nvidia remains well-positioned for long-term success. Its strategic focus on AI infrastructure and partnerships with major cloud providers underpin its dominance in the AI chip market. Nvidia stock has surged nearly 200% year-to-date, far outpacing rivals like AMD and Intel.

Investors will closely monitor how Nvidia’s fourth-quarter performance shapes broader market trends. With the “age of AI” in full steam, Nvidia’s ability to sustain growth and innovate will be key to maintaining its leadership position.

Nvidia earning report reaffirm its dominance in the AI-driven tech landscape, but sky-high expectations leave little room for error. For investors still asking “What is Nvidia?” or tracking the Nvidia stock price, the company’s trajectory exemplifies the transformative power of AI in reshaping industries and markets alike. While challenges persist, Nvidia remains a cornerstone of the AI revolution.