Tesla stock took a stumbled this week as a public clash between CEO Elon Musk and President Donald Trump rattled investors, raising concerns over government contracts, EV subsidies, and regulatory uncertainty. Here’s an in-depth look at how Tesla stock fell, what triggered the selloff, and what could come next.

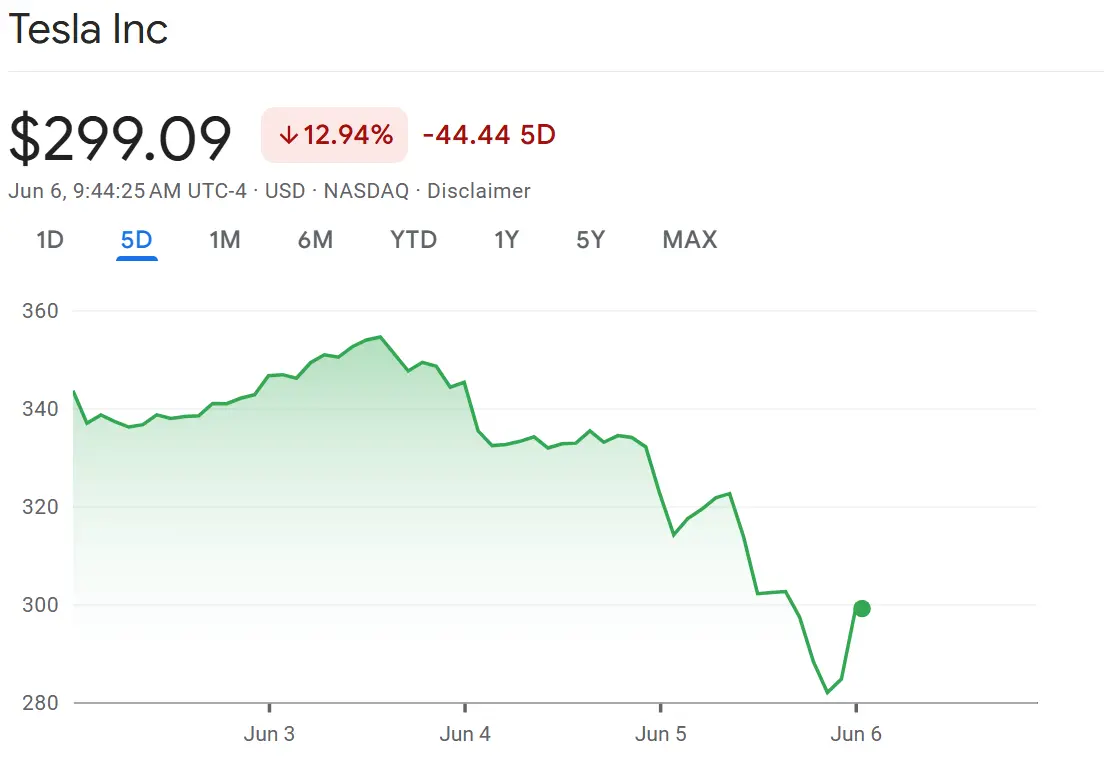

Tesla Stock Down Over 14%, Erasing $150B in Value

On Thursday, Tesla stock tumbled 14.3%, wiping out approximately $150 billion in market capitalization—a record single-day loss for the company. The selloff was triggered by Trump’s threats to revoke government contracts from Musk’s companies in retaliation for Musk’s vocal criticism of Trump’s spending bill, which proposed eliminating key electric vehicle tax credits.

As of Friday’s trading session, Tesla shares closed at $284.70, a sharp fall from recent highs, and dropped through several key technical levels like the 21-, 50-, and 200-day moving averages.

What Sparked the Clash Between Musk and Trump?

The public dispute began when Musk criticized Trump’s tax bill on X, branding the exclusion of EV credits a “disgusting abomination.” Trump retaliated, dismissing Musk, threatening to strip Tesla and SpaceX of lucrative government deals, and even removing Musk’s EV mandate.

Trump stated from the Oval Office, “I was surprised,” and warned Musk of shifting relationships. Musk fired right back on X, quipping “Whatever,” and claimed on the platform that the Trump administration owed much of its election success to Musk’s influence.

Market Fallout and Regulatory Worries

Financial markets reacted sharply, with Tesla shares down nearly 18% from the previous week’s high, even though May brought a 22% rally. Analysts warn the spat could threaten Tesla’s autonomous-driving ambitions—like robotaxi’s federal approvals—and risk disruptive policy shifts.

Despite gains in other areas, the broader market saw Nasdaq dip by about 0.8%, while Tesla Media stocks (DJT) also suffered backlash from the ongoing dispute.

Can Tesla Shares Recover?

By Friday trading, Tesla stock showed signs of stabilization, rising as much as 5% in pre-market trading. This followed a rumored (though unconfirmed) call between Musk and Trump, prompting cautious optimism that tensions may be easing. Still, the White House later denied any formal call was scheduled.

Analysts caution that true détente could help rebuild investor trust and smooth Tesla’s path through future regulatory hurdles.

Tesla’s Earnings Reports Recap

Besides the feud, Tesla faces substantive strategic headwinds:

-

Declining EV sales in Europe and China.

-

Underwhelming Full Self-Driving (FSD) system upgrades, especially in China.

-

Intense competition from rivals such as Waymo in autonomous ride-hailing.

-

Pressure to launch robotaxi services soon—from Austin, with competitors already active.

Market watchers still see Tesla as a high-value but highly volatile bet, with many pointing to its long-term potential around autonomy, while others warn of distractions due to Musk’s ongoing political and business activities.

So What Should Shareholders Do?

Considering the turbulence, investors should weigh:

-

Short-term risk from political backlash and regulatory unpredictability.

-

Long-term upside tied to autonomy, energy products, and market leadership.

-

Risk tolerance—Tesla trades at a high multiple, demanding a strong belief in Musk’s vision.

-

Diversification, as macroeconomic shifts—including payroll data and Fed moves—can heavily impact tech stocks like Tesla.

Will Trump-Musk Tensions Ease?

With some signs of conflict cooling and hopes of a dialogue, Tesla investors may find relief. Still, Musk’s bold political posture—and Trump’s willingness to push back—adds a volatile layer atop the company’s existing business challenges.

For now, volatility remains the watchword: Tesla stock is down, investors are cautious, and the stock’s trajectory may hinge on both its business performance and its unpredictable relationship with political power.