Microsoft Corporation (NASDAQ: MSFT) achieved a significant milestone by surpassing a $4 trillion market capitalization, becoming only the second publicly traded company to reach this valuation, following Nvidia. This achievement was propelled by the company’s robust fourth-quarter earnings, which exceeded analyst expectations and underscored the growing demand for its cloud and artificial intelligence (AI) services.

Microsoft Stock: Strong Q4 Earnings Drive Market Cap Surge

Microsoft reported fourth-quarter fiscal year 2025 earnings of $3.65 per share on revenue of $76.4 billion, surpassing analyst estimates of $3.37 per share and $73.9 billion in revenue. The company’s net income rose 24% year-over-year to $27.2 billion, reflecting strong performance across its business segments.

A significant contributor to this growth was the Azure cloud platform, which experienced a 39% year-over-year revenue increase, bringing in over $75 billion for the fiscal year. Overall, Microsoft’s cloud revenue reached $46.7 billion in the quarter, up 27% from the previous year. Barron’s

AI and Cloud Services Growth

CEO Satya Nadella attributed the company’s strong performance to the growing demand for AI-powered services and cloud computing solutions. Microsoft’s exclusive partnership with OpenAI has enabled rapid deployment of AI products like the Microsoft 365 Copilot assistant, contributing to the company’s competitive edge in the AI space.

To meet the increasing demand, Microsoft plans to invest $30 billion in capital expenditures in the upcoming quarter, focusing on expanding its AI infrastructure and data centers. This investment aims to address supply constraints and position the company for sustained growth in the AI era.

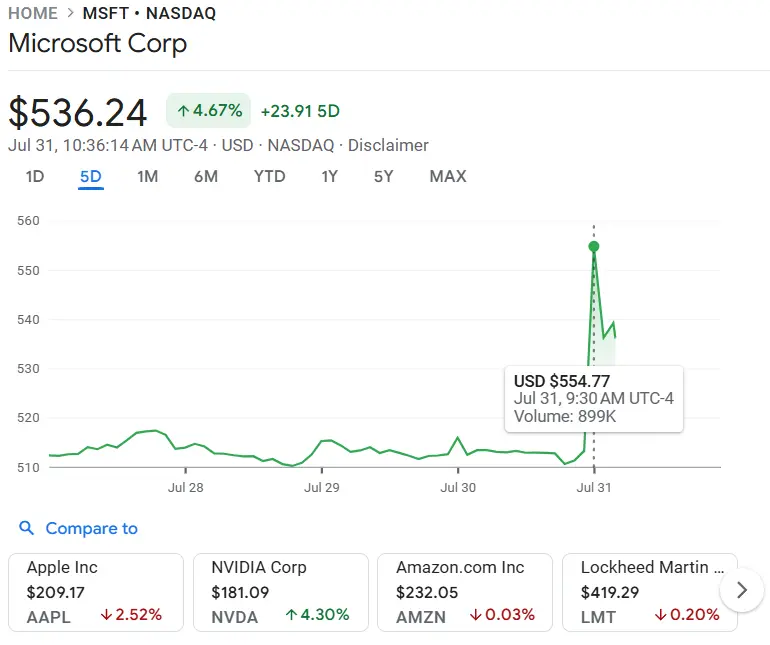

Following the earnings announcement, Microsoft’s stock price surged over 5%, reaching $540.92 per share and pushing its market capitalization above $4 trillion. This valuation places Microsoft among the world’s most valuable companies, trailing only Nvidia, which currently leads with a market cap of $4.44 trillion.

Despite this achievement, some analysts caution that the company’s current valuation may limit future returns. For instance, Seeking Alpha suggests that Microsoft’s valuation could restrict annual returns to below 10%, indicating a potential slowdown in growth momentum.

Looking ahead, Microsoft projects double-digit revenue and operating income growth for fiscal year 2026. The company plans to continue its focus on AI and cloud services, areas that have been central to its recent success. Additionally, Microsoft is diversifying its AI offerings by incorporating models from other providers like Meta’s Llama and Elon Musk’s Grok, ensuring a comprehensive approach to AI development.

However, the company also faces challenges, including regulatory scrutiny over its AI practices and competition from other tech giants. Microsoft’s ability to navigate these challenges while maintaining its growth trajectory will be crucial in sustaining its market position.

Key Takeaways

-

Earnings Performance: Microsoft reported Q4 earnings of $3.65 per share on revenue of $76.4 billion, exceeding expectations.

-

Cloud Growth: Azure’s revenue grew 39% year-over-year, contributing significantly to the company’s overall growth.

-

Market Milestone: The company’s market capitalization surpassed $4 trillion, making it the second company to achieve this feat.

-

Strategic Investments: Microsoft plans to invest $30 billion in capital expenditures to expand its AI infrastructure.

-

Analyst Perspectives: Some analysts express caution regarding the company’s high valuation and potential impact on future returns.

Microsoft’s strong financial performance and strategic investments position it well for continued growth in the AI and cloud computing sectors. However, the company must address regulatory challenges and market competition to sustain its leadership in the tech industry.

Microsoft’s breathtaking rise past the $4 trillion valuation milestone underscores its dominance in the cloud and AI space. With record-breaking earnings and ambitious reinvestment plans, the company reaffirmed its position as a linchpin of the tech sector. Yet, investors and analysts remain cautious, watching to see if Microsoft can sustain such lofty expectations amid rising costs and a potentially saturated market.