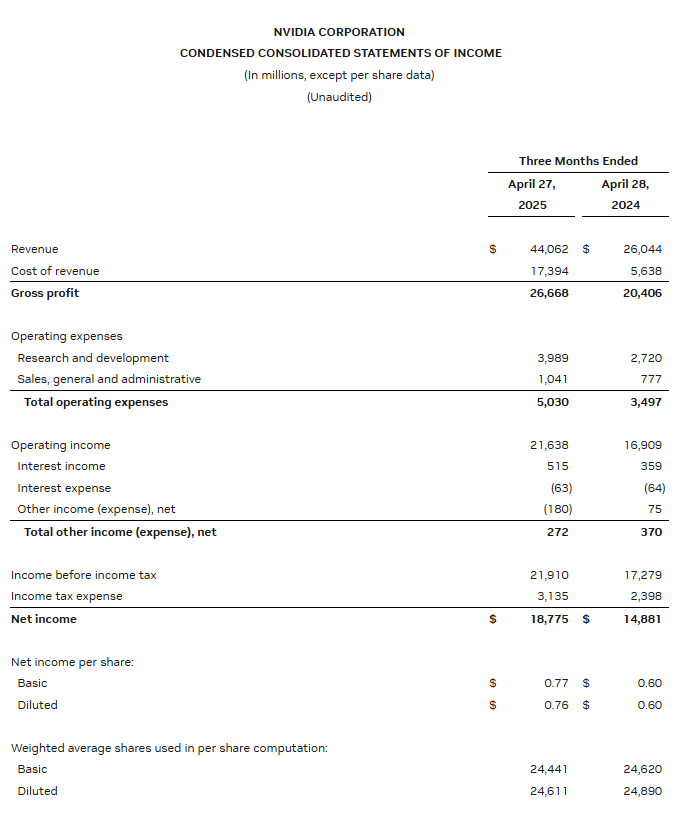

Nvidia Reports Impressive Q1 FY2026 Earnings

Nvidia has announced its financial results for the first quarter of fiscal year 2026, showcasing a significant year-over-year revenue increase of 69%, reaching $44.1 billion. Despite facing challenges from U.S. export restrictions, the company’s net income rose by 26% to $18.8 billion. Excluding a $4.5 billion charge related to these restrictions, adjusted earnings per share stood at $0.96, surpassing analysts’ expectations of $0.73.

Impact of The Tariffs

The U.S. government’s recent export restrictions, particularly affecting Nvidia’s H20 AI chips, have posed significant challenges. These restrictions led to a $4.5 billion charge due to excess inventory and purchase obligations. Additionally, Nvidia was unable to ship an estimated $2.5 billion worth of H20 products in the first quarter. Looking ahead, the company anticipates an $8 billion revenue loss in China for the current quarter.

CEO Jensen Huang Addresses Policy Implications

During the Nvidia earnings call, CEO Jensen Huang expressed concerns over the long-term implications of U.S. export restrictions, suggesting they might inadvertently bolster China’s domestic chip industry. He emphasized the strategic importance of China as a major AI market and highlighted Nvidia’s plans to expand its global footprint, including partnerships in the Middle East and Europe.

Nvidia Stock Price Climbing

Following the earnings announcement, Nvidia’s stock price experienced a notable increase, rising by 5.8% in after-hours trading. This surge reflects investor confidence in the company’s resilience and growth prospects, despite ongoing geopolitical challenges.

Outlook for the Next Quarter

Nvidia projects revenue of $45 billion for the second quarter of fiscal year 2026, indicating continued strong demand for its AI infrastructure products. The company remains committed to navigating the complexities of international trade policies while focusing on innovation and global expansion.

For a deeper dive into how Nvidia’s record-breaking earnings are shaking up the market despite U.S.-China trade tensions, read our detailed breakdown at TTRGroup.