Tesla stock has taken a sharp hit, dropping by 15.43% in just one trading day. This dramatic fall has left investors questioning the company’s direction and future. Several factors contributed to this decline: UBS slashed its price target from $259 to $225, and Tesla’s Q4 2024 earnings revealed revenue of $25.7 billion, falling short of expectations. Automotive revenue dropped by 8%, though energy generation and storage revenue showed growth. These numbers highlight the challenges Tesla faces in maintaining its market dominance. You must stay informed to navigate this volatile situation effectively.

Key Takeaways

- Tesla’s stock fell 15.43% in one day, worrying investors about its future.

- New leaders are working to make better decisions and improve production as competition grows.

- Tesla’s latest earnings report showed higher revenue but lower car profit margins.

- Problems with global supply chains and higher material costs make it hard for Tesla to stay profitable.

- Investors should watch for rule changes and market trends that could affect Tesla’s stock.

Recent News Driving Tesla Stock Headlines

Key Announcements from Tesla

Leadership Updates and Strategic Decisions

Tesla recently announced a reshuffle in its leadership team, aiming to streamline operations and enhance decision-making. You might have noticed that these changes come at a critical time when the company faces mounting competition and market pressures. Elon Musk, Tesla’s CEO, has reiterated his commitment to focusing on Tesla’s core business, despite his involvement with other ventures like SpaceX and X (formerly Twitter). This dual focus has raised concerns among investors about his ability to steer Tesla effectively during turbulent times.

Tesla also revealed plans to optimize its production strategy by focusing on cost efficiency. This decision aligns with the company’s goal to maintain profitability in a challenging economic environment. However, some analysts believe these measures may not be enough to offset declining automotive margins, which fell to 18.9% in Q4 2023, down from 25.9% the previous year.

Product Launches and Innovations

Tesla continues to innovate, with recent announcements about the Cybertruck finally entering production. This long-awaited launch has generated excitement, but delays and production challenges have tempered investor enthusiasm. Tesla also hinted at advancements in its Full Self-Driving (FSD) technology, which could redefine the EV market. Yet, regulatory hurdles and safety concerns remain significant obstacles.

Industry and Market News

EV Market Trends and Competition

The global EV market has seen rapid growth, with the market capitalization of pure-play EV makers reaching $1 trillion by the end of 2023. However, Tesla’s shares have been 15% lower on average in 2023 compared to previous years, reflecting increased volatility. You should also consider that traditional automakers are catching up, offering competitive EV models at lower price points. This intensifying competition has put pressure on Tesla to innovate and maintain its market share.

Global Supply Chain Challenges

Supply chain disruptions continue to impact Tesla and the broader EV industry. Rising costs for raw materials like lithium and cobalt have squeezed margins, while geopolitical tensions have disrupted global trade routes. Tesla’s ability to navigate these challenges will be crucial for its future success.

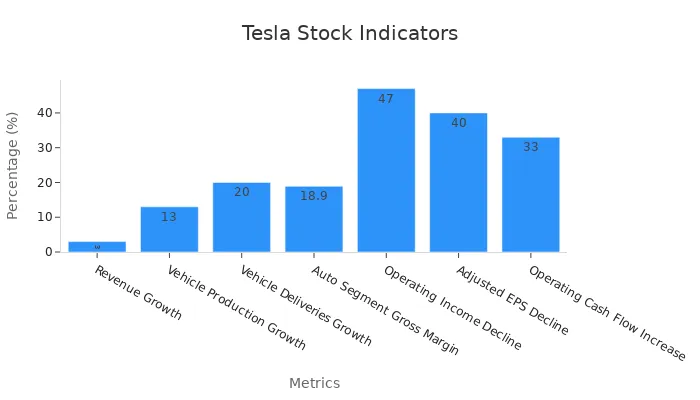

Here’s a snapshot of Tesla’s key financial indicators:

| Metric | Value |

|---|---|

| Revenue Growth | 3% |

| Vehicle Production Growth | 13% |

| Vehicle Deliveries Growth | 20% |

| Auto Segment Gross Margin | 18.9% |

| Operating Income Decline | 47% |

| Adjusted EPS Decline | 40% |

| Operating Cash Flow Increase | 33% |

These figures highlight the challenges Tesla faces in maintaining its leadership in the EV market.

Tesla’s Financial Performance and Stock Trends

Recent Earnings Report

Revenue and Profit Analysis

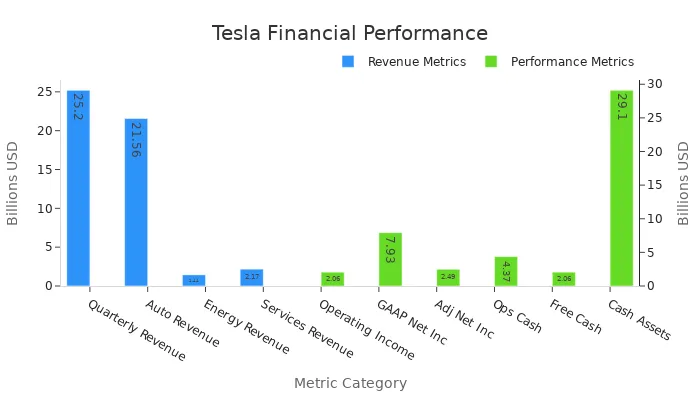

Tesla’s latest earnings report paints a mixed picture of its financial health. You can see that the company achieved quarterly revenue of $25.2 billion, a modest 3% year-over-year increase. However, this fell short of the $25.6 billion analysts had expected. The automotive segment, which remains Tesla’s core business, contributed $21.56 billion, reflecting just a 1% growth. This sluggish performance stems from a lower average selling price (ASP) due to recent price cuts.

On the brighter side, Tesla’s energy generation and storage segment grew by 10%, generating $1.44 billion. Services and other revenue also surged by 27%, showcasing Tesla’s ability to diversify its income streams. Yet, the automotive gross margin dropped to 18.9%, a sharp decline from 25.9% a year ago. This margin compression, coupled with a 47% drop in operating income, highlights the financial strain caused by aggressive pricing strategies and rising costs.

Here’s a detailed breakdown of Tesla’s financial metrics:

| Metric | Q4 2023 Value | Year-over-Year Change | Notes |

|---|---|---|---|

| Quarterly Revenue | $25.2 billion | +3% | Fell short of $25.6 billion expected; driven by increased vehicle deliveries. |

| Automotive Segment Revenue | $21.56 billion | +1% | Revenue impacted by lower average selling price (ASP). |

| Energy Generation Revenue | $1.44 billion | +10% | |

| Services and Other Revenue | $2.17 billion | +27% | |

| Automotive Gross Margin | 18.9% | -7% | Down from 25.9% year-ago; due to price cuts on vehicles. |

| Operating Income | $2.06 billion | -47% | Decline driven by lower ASP and increased operating expenses. |

| Operating Margin | 8.2% | -7.8% | Lower than 16% in the year-ago period. |

| GAAP Net Income | $7.93 billion | +112% | Boosted by a one-time non-cash tax benefit. |

| Adjusted Net Income | $2.49 billion | -40% | Slightly missed Wall Street’s expectation of $0.74 EPS. |

| Cash Generated from Operations | $4.37 billion | +33% | |

| Free Cash Flow | $2.06 billion | +45% | |

| Cash, Cash Equivalents, and Short-term Investments | $29.1 billion | +31% |

Analyst Reactions and Key Metrics

Analysts have expressed mixed reactions to Tesla’s financial performance. Some view the revenue growth as a positive sign, while others remain concerned about the declining margins. The adjusted net income of $2.49 billion missed Wall Street’s expectations, further fueling skepticism. You might find it interesting that Tesla’s cash flow increased by 33%, reaching $4.37 billion, which provides a cushion for future investments.

Stock Price Movements

Tesla Stock’s Recent Decline

Tesla stock has faced significant pressure following the earnings report. The 15.43% drop in a single trading day reflects investor concerns over the company’s ability to sustain its growth trajectory. You should note that the declining automotive margins and missed revenue expectations have amplified this sell-off.

Comparison to Broader Market Trends

When compared to the broader market, Tesla stock’s recent performance stands out for its volatility. While the S&P 500 and Nasdaq indices have shown resilience, Tesla’s sharp decline underscores the challenges unique to the EV sector. This divergence highlights the importance of closely monitoring industry-specific factors when evaluating Tesla stock.

External Factors Influencing Tesla Stock

Macroeconomic Trends

Impact of Interest Rates and Inflation

You’ve likely noticed how rising interest rates and inflation have shaken the financial markets. For Tesla, these macroeconomic factors create a double-edged sword. Higher interest rates increase borrowing costs, making it more expensive for Tesla to fund its ambitious projects. At the same time, inflation drives up the cost of raw materials like lithium and nickel, squeezing profit margins.

For you as an investor, this means Tesla’s ability to maintain profitability becomes even more critical. When inflation rises, consumers may hesitate to purchase high-ticket items like electric vehicles (EVs). This could slow Tesla’s sales growth, directly impacting its stock performance.

Global Economic Uncertainty

Economic uncertainty on a global scale also plays a significant role. You’ve seen how geopolitical tensions and trade disruptions can ripple through industries. For Tesla, these challenges affect supply chains and production timelines. For example, delays in sourcing critical components could lead to missed delivery targets, which often trigger stock sell-offs.

Tesla’s global footprint exposes it to risks in multiple regions. If you’re considering investing, you should evaluate how these uncertainties might influence Tesla’s ability to meet its growth objectives.

Regulatory and Policy Updates

Changes in EV Subsidies and Tax Credits

Regulatory changes often act as a catalyst for Tesla’s stock movements. Policies like EV subsidies and tax credits directly impact Tesla’s sales and, by extension, its stock price.

- Investor optimism about favorable policy shifts often boosts Tesla’s stock.

- Tax credits have significantly influenced sales of Tesla models, especially the Model Y.

- When subsidies increase, Tesla benefits from higher demand, which can lead to stock price surges.

If you’re tracking Tesla, keep an eye on these policy updates. They could present opportunities for gains or signal potential risks.

Environmental and Emissions Regulations

Stricter environmental regulations also shape Tesla’s trajectory. Governments worldwide are pushing for lower emissions, creating a favorable environment for EV makers. Tesla, as a market leader, stands to benefit. However, compliance with these regulations requires continuous innovation, which adds to operational costs.

For you, this means Tesla’s ability to adapt quickly will determine its long-term success. Regulatory shifts could either strengthen Tesla’s market position or expose vulnerabilities, depending on how the company responds.

Why is Tesla Stock Dropping?

Short-Term Considerations

Risks Associated with Recent Volatility

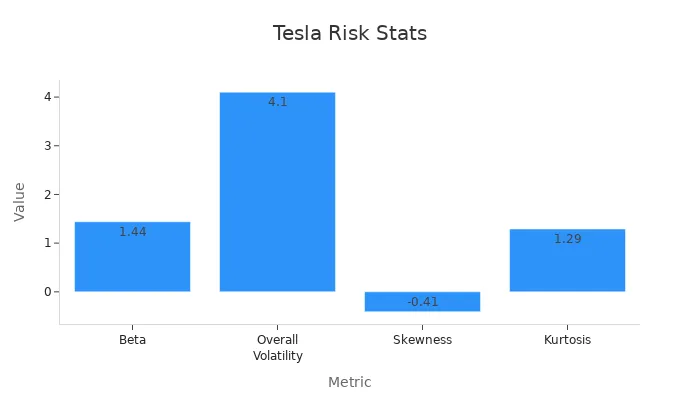

Tesla’s stock has shown extreme volatility, making it one of the riskiest investments in the S&P-100. With an annualized standard deviation of 68.7%, you face significant price swings that can lead to unexpected losses. The stock’s beta of 1.44 indicates it is more volatile than the broader market, amplifying risks during economic downturns.

| Metric | Value |

|---|---|

| Beta | 1.44 |

| Overall Volatility (σ) | 4.10 |

Additionally, Tesla’s Relative Strength Index (RSI) recently dropped below 30, signaling oversold conditions. While this suggests a potential price reversal, the stock’s movement below key support levels raises concerns about further declines. You should also consider Tesla’s high valuation metrics, such as a P/E ratio of 107.75 and a P/B ratio of 20.01, which indicate overvaluation and potential for correction.

Opportunities for Short-Term Gains

Despite the risks, Tesla’s current RSI suggests a buying opportunity for short-term traders. Oversold conditions often lead to price rebounds, allowing you to capitalize on quick gains. Tesla’s strong cash flow and diversified revenue streams provide a cushion against market shocks, making it an attractive option for risk-tolerant investors.

- Annualized Standard Deviation: 68.7% indicates high volatility.

- RSI: Below 30 suggests oversold conditions, favoring a price reversal.

- Price-to-Sales (P/S) Ratio: Highlights Tesla’s revenue potential relative to its stock price.

Long-Term Outlook

Tesla’s Growth Potential in the EV Market

Tesla continues to dominate the EV market, with production increasing by 13% and deliveries rising by 20% year-over-year in Q4. These figures demonstrate Tesla’s ability to scale operations and meet growing demand. However, competition is intensifying. By 2025, automakers like Volkswagen and General Motors aim to produce millions of EVs, potentially challenging Tesla’s market share.

- Tesla produced 494,989 vehicles in Q4, a 13% increase from the previous year.

- Deliveries reached 484,507 vehicles, marking a 20% year-over-year growth.

Broader Impacts on the Clean Energy Sector

Tesla’s innovations extend beyond EVs, influencing the clean energy sector. Its advancements in energy storage and solar technology position it as a leader in sustainable solutions. For you, this means Tesla’s long-term success could drive broader adoption of clean energy, benefiting both the environment and your portfolio. However, maintaining this leadership requires continuous investment and innovation, which could strain resources in the short term.

Tesla’s recent stock decline underscores the unpredictable nature of the EV market. You’ve seen how financial performance, market competition, and external pressures like inflation and regulatory changes have shaped this outcome. Key metrics reveal the challenges:

- RSI at 78.33 signals overbought conditions, hinting at overvaluation.

- P/E Ratio of 107.75 and P/B Ratio of 20.01 highlight Tesla’s premium pricing.

- Annualized Volatility of 0.63 reflects significant price swings.

As an investor, you must weigh these risks against Tesla’s long-term potential. By staying informed and strategic, you can navigate this volatile landscape effectively.