Key Financial Highlights

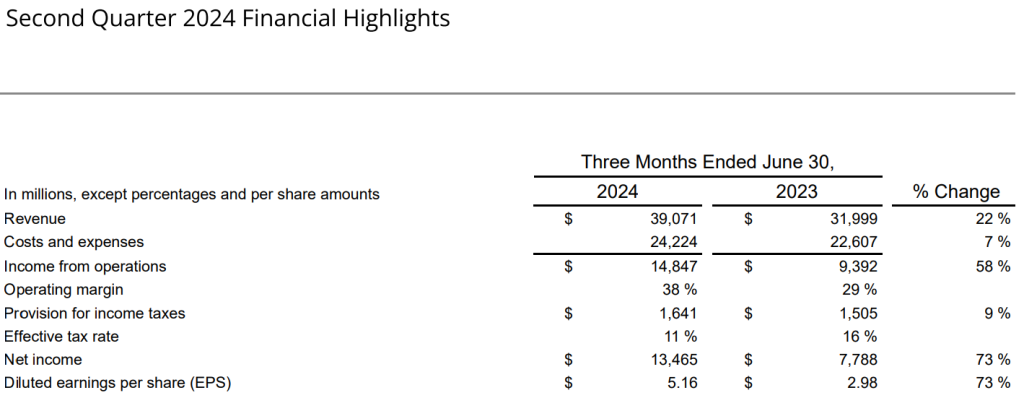

Meta reported earnings per share (EPS) of $5.16 on revenue of $39.07 billion, outpacing analysts’ predictions of $4.74 EPS on $38.3 billion in revenue. This represents a notable increase from the same period last year, where Meta recorded EPS of $2.98 on $31.9 billion in revenue. The company’s Family of Apps revenue, which includes Facebook, Instagram, WhatsApp, and Messenger, came in at $38.72 billion, higher than the estimated $37.7 billion.

Meta’s Q2 2024 Financial Highlights:

- Earnings per share: $5.16 vs. $4.74 expected

- Revenue: $39.07 billion vs. $38.3 billion expected

- Family of Apps revenue: $38.72 billion vs. $37.7 billion expected

- Net income: $13.47 billion, a 73% increase from $7.79 billion last year

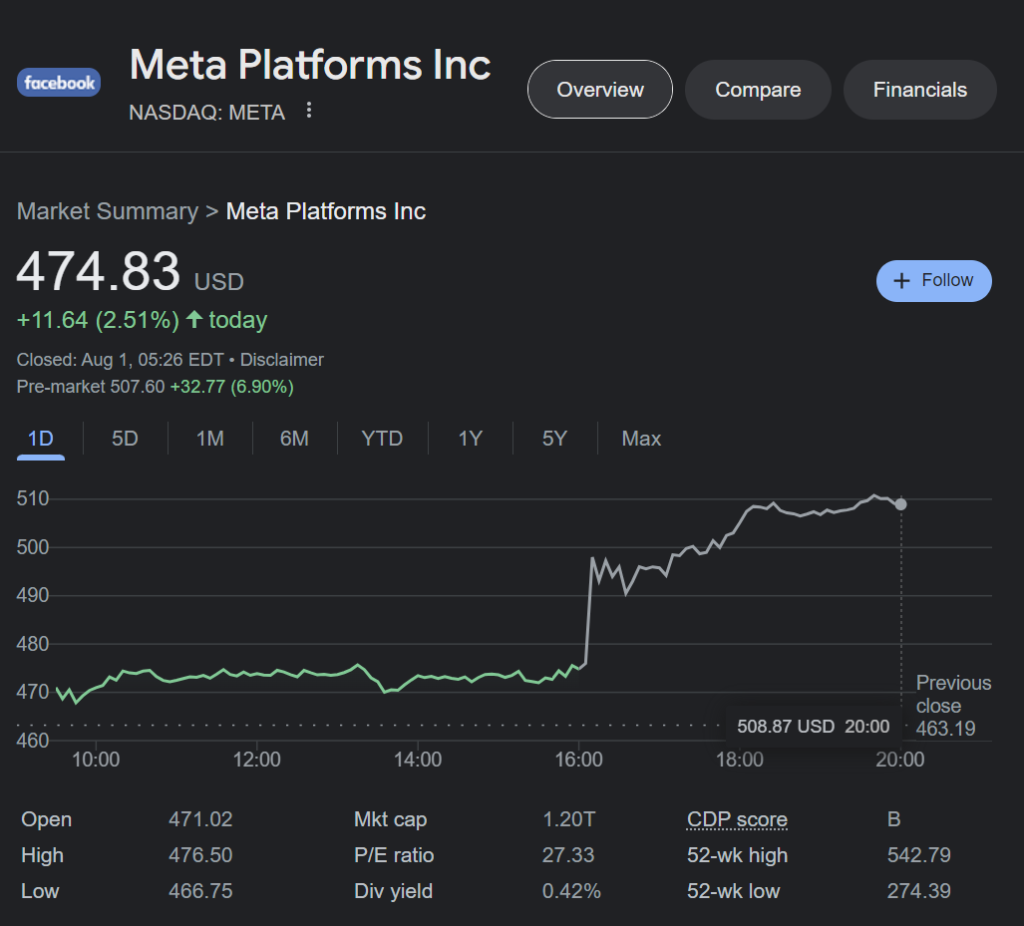

Meta Stock Price Performance

Following the earnings announcement, Meta stock price on Nasdaq surged by more than 4% in after-hours trading, reflecting investor confidence in the company’s growth trajectory. Meta’s stock has shown a remarkable performance this year, with shares up 34% year-to-date, doubling the gains of the Nasdaq index .

For investors tracking Meta stock futures and Meta stock tradingview metrics, the positive earnings report has provided a bullish outlook, further solidifying Meta’s position as a leading tech stock.

AI and Infrastructure Investments

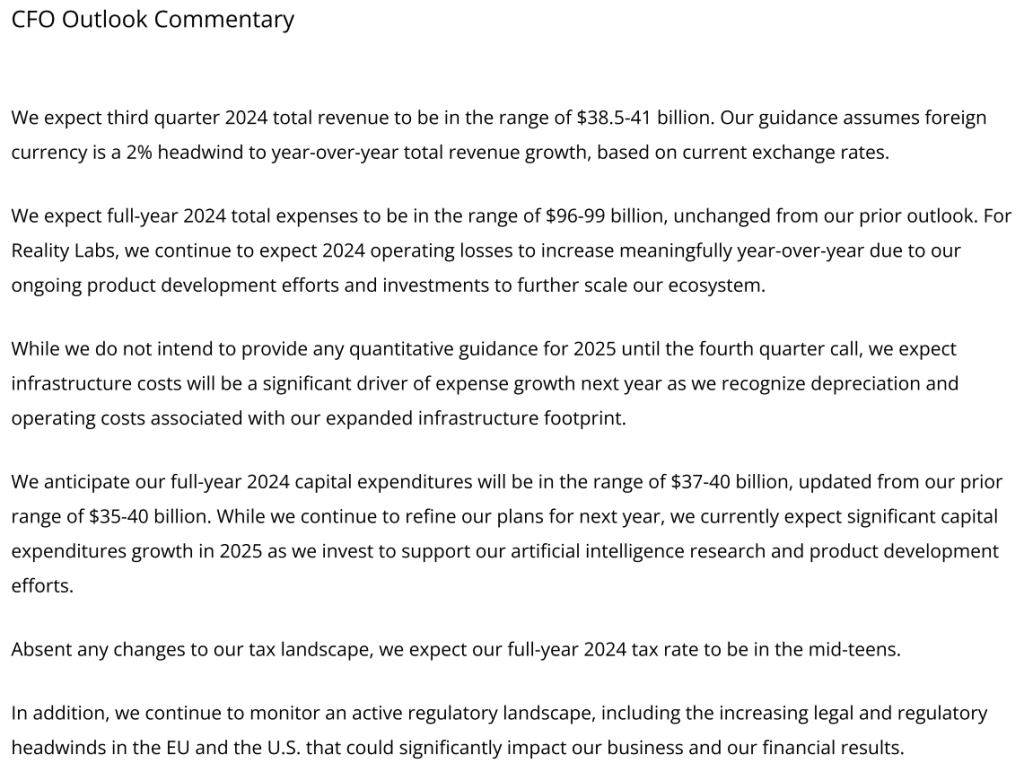

Meta’s significant investments in AI and its infrastructure have been a focal point for investors. The company’s CFO, Susan Li, highlighted that Meta expects substantial capital expenditures growth in 2025 to support its AI research and product development efforts . This includes plans to enhance its computing infrastructure with 350,000 Nvidia H100 graphics cards by the end of 2024, aimed at training large language models (LLMs) and related AI software.

CEO Mark Zuckerberg emphasized Meta’s commitment to open-source AI development, introducing the latest version of its Llama AI model, Llama 3.1. This model is expected to drive significant advancements in AI capabilities, positioning Meta as a leader in the AI space alongside competitors like OpenAI and Google .

Legal and Regulatory Challenges

Amidst its financial successes, Meta also faces regulatory scrutiny. Recently, the company agreed to a $1.4 billion settlement with the state of Texas over allegations of unauthorized use of biometric data for its Tag Suggestions feature . Despite these challenges, Meta’s strong financial performance and strategic investments in AI provide a positive outlook for its stock.

Outlook on Meta Stock

Looking forward, Meta has provided a revenue guidance of $38.5 billion to $41 billion for Q3 2024, which exceeds analyst expectations . The company’s ongoing efforts to streamline operations, coupled with its focus on cutting-edge technologies like AI and the metaverse, are expected to drive future growth.

For those tracking the stock quote for Meta, value of Meta stock, and Meta stock price Nasdaq, the company’s robust earnings report and strategic investments offer a promising outlook. Furthermore, the historical performance and future projections indicate that Meta remains a strong contender in the tech industry, with the potential for continued stock appreciation.

In summary, Meta’s Q2 2024 earnings report highlights its strong financial performance, strategic investments in AI, and the challenges it faces. Investors are optimistic about the future of Meta stock, given the company’s commitment to innovation and growth. As Meta continues to navigate the evolving tech landscape, its stock remains a valuable asset for investors seeking exposure to the dynamic tech sector.

For more details about Meta’s Q2 2024 financial results, you can read the full report here.